As a homeowner, you may wonder if your insurance policy covers mold damage, particularly toxic mold. Mold is a common issue for homeowners, and can cause serious health problems if left untreated. It’s important to know whether or not your homeowners insurance covers mold damage, including toxic mold, and what your policy may entail.

In this article, we’ll explore the topic of mold coverage in homeowners insurance in detail. We’ll answer the question of whether or not it covers toxic mold, explain the importance of having mold coverage, and provide guidance on what to look for in a policy. We’ll also offer practical advice on how to prevent mold in your home and what to do if you find it.

So, if you’re a homeowner wondering about mold coverage in your insurance policy, read on to find out more.

Understanding Mold

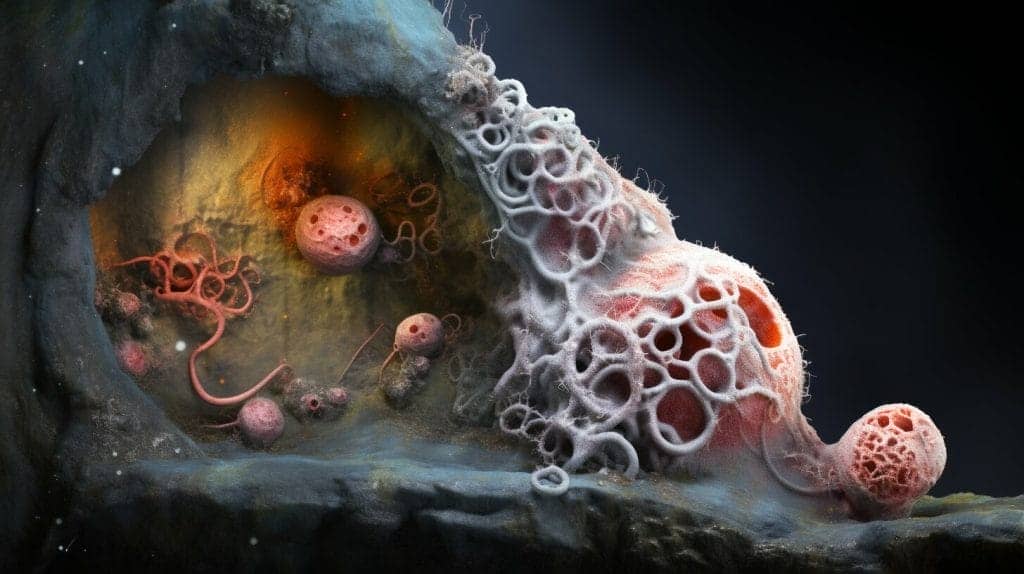

Mold is a type of fungus that grows in damp and humid conditions. It can be found both indoors and outdoors, and it thrives in areas with high moisture levels, such as bathrooms, kitchens, and basements. Mold spores can travel through the air, and when they land on a damp surface, they can grow and spread quickly.

While not all mold is toxic, some types of mold, such as black mold, can cause health problems for some people. Symptoms can include respiratory issues, headaches, and allergic reactions.

Mold growth in your home can also cause damage to the structure of your property. It can weaken walls, floors, and ceilings, and it can also damage furniture and other items.

Why Mold Coverage is Important

If you’re a homeowner, mold coverage in your homeowners insurance policy is crucial, particularly when it comes to toxic mold.

Without proper coverage, the costs of mold damage remediation can quickly add up. In addition to the physical damage, mold can also pose serious health risks to you and your family, especially when it comes to toxic mold.

| Mold Coverage in Home Insurance Policy | What it can include |

|---|---|

| Remediation costs | The cost to clean up the mold damage and make necessary repairs to your home. |

| Living expenses | In the event that you are forced to leave your home during the remediation process, your policy may cover temporary living expenses like hotel rooms or rentals. |

| Personal belongings | Your insurance may cover the cost to replace personal property that was damaged or lost due to mold. |

It’s important to note that mold coverage may not be automatically included in your policy, so be sure to check with your insurance provider to see if it is included or if it is an additional coverage option.

If you live in an area with high humidity or a history of mold issues, it’s especially important to have mold coverage in your policy.

What Mold Coverage Typically Includes

Mold coverage in a home insurance policy typically includes coverage for:

| Item | Description |

|---|---|

| Remediation Costs | The cost to remove mold from your home, including cleaning and repairs to areas affected by mold. |

| Testing Costs | The cost to test your home for mold, which may be necessary to determine the extent of the damage. |

| Living Expenses | If mold damage makes your home uninhabitable, this coverage will pay for your living expenses while repairs are made. |

| Property Damage | This coverage will pay for repairs or replacement of personal property damaged by mold, such as furniture, clothing, and electronics. |

It’s important to note that coverage can vary depending on your policy and the extent of the damage. Some policies may have limits on the amount they will pay for mold damage, while others may exclude certain types of mold or limit coverage based on the cause of the mold growth.

It’s always important to carefully review your policy to understand what is and is not covered, and to contact your insurance provider for clarification if necessary.

What Mold Coverage Does Not Include

While mold coverage in homeowners insurance policies can provide crucial protection in the event of mold damage, it’s important to note that not all types of mold damage are covered.

Specifically, mold damage caused by lack of maintenance or negligence by the homeowner is generally not covered by insurance policies. This includes situations where the homeowner fails to address known leaks or moisture issues, or fails to take action to prevent mold growth.

Additionally, some insurance policies may have limits on the amount of coverage provided for mold damage. It’s important to review your policy carefully to understand what type of mold damage is covered and what limits may apply.

If you do experience mold damage that is not covered by your insurance policy, you may need to cover the costs of remediation and repairs out of pocket. This is why it’s important to take steps to prevent mold growth in your home and address any moisture issues promptly.

How to File a Mold Insurance Claim

If you do experience mold damage that is covered by your insurance policy, it’s important to file a claim promptly. To do so, you’ll typically need to provide documentation of the damage, along with proof that the mold growth was caused by a covered event.

When filing a mold insurance claim, be sure to follow your insurance company’s guidelines and provide all required documentation. It’s also a good idea to document the damage thoroughly with photos and written descriptions, and to keep a record of all communication with your insurance company.

How Mold Coverage Affects Your Premiums

When selecting a homeowners insurance policy, it’s important to consider how mold coverage can affect your premiums. Adding mold coverage to your policy can increase your premium, as it’s an additional risk that the insurance company is taking on. Your premium will depend on several factors, including:

| Factor | Impact on Premium |

|---|---|

| Location | If you live in an area prone to mold growth or with a high incidence of mold claims, your premium may be higher. |

| Home age and condition | If your home is older or has pre-existing moisture damage or mold, your premium may be higher. |

| Amount of coverage | If you choose a higher coverage limit for mold damage, your premium will be higher. |

| Deductible | If you choose a lower deductible for mold damage, your premium will be higher. |

Despite the potential increase in premiums, having mold coverage in your homeowners insurance policy can provide peace of mind and financial protection in the event of a mold issue in your home.

What to Look for in Mold Coverage

When selecting a homeowners insurance policy, it’s essential to consider what it covers in terms of mold damage. Here are some of the key factors to keep in mind when evaluating mold coverage in your policy:

Types of Mold Damage Covered

Make sure your policy specifies what types of mold damage are covered. Some policies may only cover damage caused by certain types of mold or have specific exclusions for certain types of damage.

Expenses Covered

Review your policy to see what expenses are covered in the event of mold damage. This may include costs for mold remediation, temporary housing, and repairs to damaged property.

Policy Limits

Check the policy limits to ensure they are sufficient to cover the potential costs of mold damage. Some policies may have lower limits or require additional coverage for certain types of mold damage.

Deductibles

Review the policy’s deductible to ensure it is affordable and appropriate for your needs. Keep in mind that a higher deductible may result in lower premiums, but also means you’ll pay more out of pocket in the event of a claim.

Policy Exclusions

Make sure you understand any policy exclusions that could impact your coverage, such as mold damage caused by lack of maintenance or neglect. It’s also important to understand any time limits on filing mold insurance claims.

By understanding what to look for in mold coverage, you can make an informed decision when selecting a homeowners insurance policy that offers adequate protection for your property.

Do You Need Mold Coverage?

Whether or not you need mold coverage in your homeowners insurance policy depends on your specific circumstances. Here are some factors to consider:

- Location: If you live in an area with high humidity or frequent rain, you may be more susceptible to mold growth and should consider mold coverage.

- Type of Home: Certain types of homes, such as those in flood-prone areas or those with a history of previous mold problems, may require mold coverage.

- Budget: Consider how much you can afford to pay out of pocket for mold damage. If the potential costs are substantial, mold coverage may be worth the added expense.

- Health Conditions: If you or someone in your household has respiratory problems or allergies that could be exacerbated by mold exposure, mold coverage may be a wise investment.

Ultimately, the decision to purchase mold coverage is a personal one that should be based on your unique circumstances and risk tolerance. However, it’s important to note that without proper coverage, you may be left responsible for significant costs in the event of mold damage.

How to Prevent Mold in Your Home

Mold can be a serious problem for homeowners, but there are steps you can take to prevent it from growing in your home. Here are some practical tips:

- Keep humidity levels low, ideally below 60%. You can use a dehumidifier to achieve this.

- Fix any leaks in your roof, walls, or plumbing as soon as they’re detected to prevent water damage and mold growth.

- Ensure good ventilation in your home, especially in bathrooms, kitchens, and laundry rooms. Use exhaust fans whenever possible and keep doors open to improve airflow.

- Heating and cooling systems can also be sources of moisture and mold growth. Ensure they are regularly cleaned and serviced by a professional.

- Regularly inspect your home for any signs of mold growth, such as musty smells, discoloration on walls or ceilings, or allergic reactions from family members or pets.

By following these tips, you can reduce the risk of mold growth in your home and potentially avoid the need for costly remediation and insurance claims.

What to Do If You Find Mold in Your Home

Discovering mold in your home can be overwhelming, but it’s important to take action quickly to prevent the spread of mold and potential health risks. Here are some steps to take:

- Identify the source of the moisture: Mold thrives in damp environments, so it’s crucial to find the source of the moisture and address it. This could be a leaky pipe, roof, or foundation.

- Call a professional: While it may be tempting to try and remove the mold yourself, it’s best to call a certified mold remediation specialist. They have the expertise and equipment to safely and effectively remove the mold.

- Document the mold damage: Take photos and videos of the mold damage and any items that have been affected. This will help when filing a mold insurance claim.

- File a mold insurance claim: Contact your insurance provider and file a mold insurance claim. Be prepared to provide documentation and evidence of the mold damage.

- Prevent future mold growth: Once the mold has been removed, take steps to prevent future growth. This may include fixing any leaks, improving ventilation, and maintaining proper humidity levels in your home.

Remember, mold can spread quickly and become a serious health hazard if left unchecked. If you suspect mold in your home, don’t hesitate to take action.

Common Myths About Mold Coverage

There are many misconceptions about mold coverage in homeowners insurance. Let’s take a closer look at some of the most common myths:

| Myth | Fact |

|---|---|

| All mold is toxic. | While some types of mold can be toxic, not all mold is dangerous. However, all types of mold can cause damage to your home and should be addressed promptly. |

| Black mold is always covered by insurance. | Not all insurance policies cover black mold. It’s important to read your policy carefully to understand what is and isn’t covered. |

| Mold coverage is only necessary in humid or wet climates. | Mold can grow anywhere there is moisture, including in dry climates. Mold coverage is important regardless of where you live. |

| Homeowners insurance doesn’t cover mold damage. | Many homeowners insurance policies do include some mold coverage, particularly for damage caused by covered perils such as water damage. |

It’s important to understand the facts about mold coverage in homeowners insurance to ensure that you’re adequately protected in the event of mold damage. If you have any questions about your mold coverage, speak to your insurance provider.

Frequently Asked Questions About Mold Coverage

Still have questions about mold coverage in homeowners insurance? Here are some frequently asked questions and answers to help you better understand your coverage:

Does my homeowners insurance policy cover mold?

It depends on the specifics of your policy. Some policies may include mold coverage as an add-on, while others may not cover it at all. It’s important to review your policy and speak with your insurance provider to understand your coverage.

If I don’t have mold coverage, will my insurance cover mold damage?

If you don’t have mold coverage in your policy, your insurance likely won’t cover any damage caused by mold. It’s important to ensure you have adequate coverage to protect against the potential costs of mold damage.

What types of mold damage are typically covered?

Most mold coverage will cover damage caused by sudden and accidental events, such as burst pipes or a roof leak. However, damage caused by ongoing moisture problems or neglectful maintenance is often not covered.

What expenses are typically covered by mold coverage?

Expenses that may be covered by mold coverage can include the cost of mold remediation, repairs to damaged areas, and any temporary housing costs incurred while your home is being repaired.

What should I look for when selecting a policy with mold coverage?

When selecting a policy with mold coverage, it’s important to review the specific terms and provisions related to mold coverage. Look for a policy that covers a range of mold types and causes of damage, and ensure that the coverage limits are adequate to protect against potential costs.

What should I do if I discover mold in my home?

If you discover mold in your home, it’s important to take immediate action to address the issue. This may include contacting a professional mold remediation service and filing an insurance claim if necessary.

What are some common misconceptions about mold coverage?

Common misconceptions about mold coverage include the belief that all types of mold are toxic and that black mold is always covered by insurance. It’s important to understand the specifics of your policy and speak with your insurance provider to get a clear picture of your coverage.

Remember, mold can be a serious issue for homeowners, and having adequate coverage in your homeowners insurance policy can provide peace of mind and protection against potential costs. Review your policy, speak with your provider, and take steps to prevent mold in your home to ensure you’re prepared for any potential issues.

Dr. Francisco Contreras, MD is a renowned integrative medical physician with over 20 years of dedicated experience in the field of integrative medicine. As the Medical Director of the Oasis of Hope Hospital in Tijuana, Mexico, he has pioneered innovative treatments and integrative approaches that have been recognized globally for the treatment of cancer, Lyme Disease, Mold Toxicity, and chronic disease using alternative treatment modalities. Dr. Contreras holds a medical degree from the Autonomous University of Mexico in Toluca, and speciality in surgical oncology from the University of Vienna in Austria.

Under his visionary leadership, the Oasis of Hope Hospital has emerged as a leading institution, renowned for its innovative treatments and patient-centric approach for treating cancer, Lyme Disease, Mold Toxicity, Long-Haul COVID, and chronic disease. The hospital, under Dr. Contreras's guidance, has successfully treated thousands of patients, many of whom traveled from different parts of the world, seeking the unique and compassionate care the institution offers.

Dr. Contreras has contributed to numerous research papers, articles, and medical journals, solidifying his expertise in the realm of integrative medicine. His commitment to patient care and evidence-based treatments has earned him a reputation for trustworthiness and excellence. Dr. Contreras is frequently invited to speak at international conferences and has been featured on CNN, WMAR2 News, KGUN9 News, Tyent USA, and various others for his groundbreaking work. His dedication to the medical community and his patients is unwavering, making him a leading authority in the field.

Contreras has authored and co-authored several books concerning integrative therapy, cancer, Lyme Disease and heart disease prevention and chronic illness, including "The Art Science of Undermining Cancer", "The Art & Science of Undermining Cancer: Strategies to Slow, Control, Reverse", "Look Younger, Live Longer: 10 Steps to Reverse Aging and Live a Vibrant Life", "The Coming Cancer Cure Your Guide to effective alternative, conventional and integrative therapies", "Hope Medicine & Healing", "Health in the 21st Century: Will Doctors Survive?", "Healthy Heart: An alternative guide to a healthy heart", “The Hope of Living Cancer Free”, “Hope Of Living Long And Well: 10 Steps to look younger, feel better, live longer” “Fighting Cancer 20 Different Ways”, "50 Critical Cancer Answers: Your Personal Battle Plan for Beating Cancer", "To Beat . . . Or Not to Beat?", and “Dismantling Cancer.”